Local Homeownership Rate Rises for First Time in 8 Years. What Does that Mean for the Labor Force?

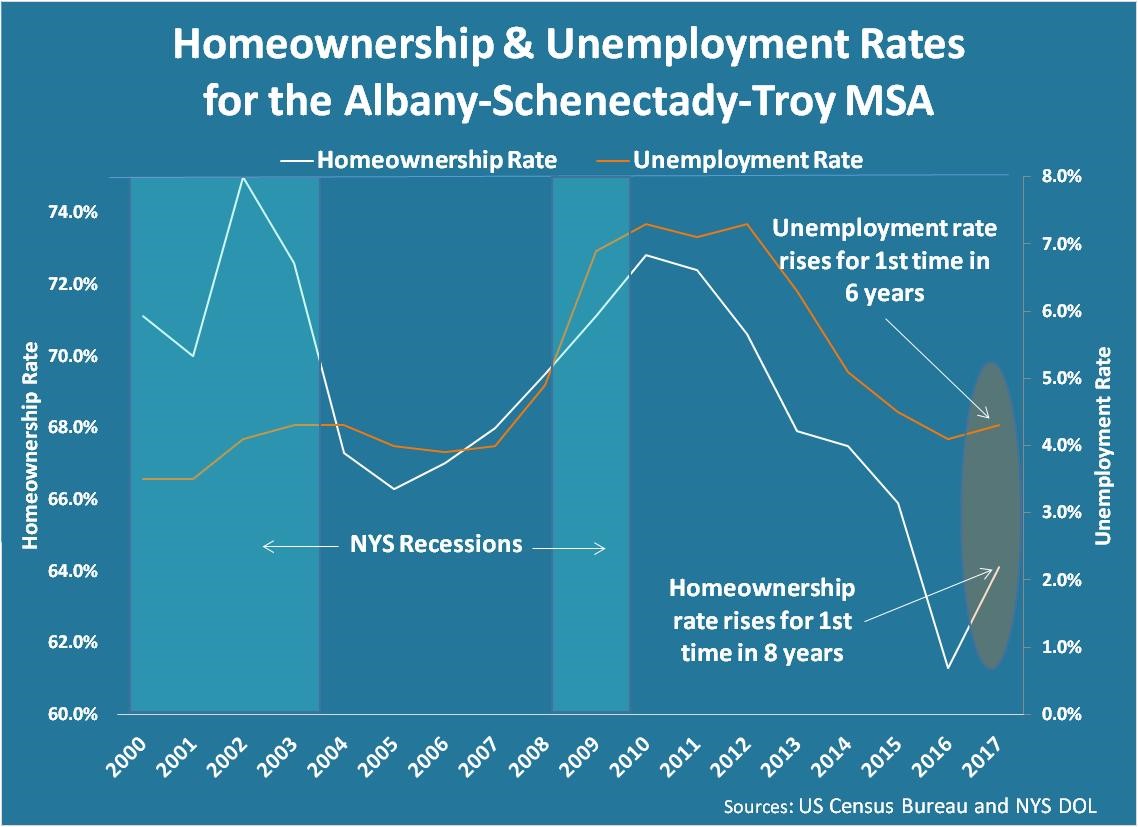

The area’s homeownership rate last year rose for the first time since 2010. The uptick in this rate may provide clues to the area’s coinciding increase in its unemployment rate for the first time in six years, though economists remain divided over whether there is not only correlative but also a causal relationship between these two indicators.

In 2017, the homeownership rate of the Albany-Schenectady-Troy metropolitan statistical area (MSA) rose over the year by 2.8 percentage points to 64.1 percent. That marked the first time that rate has annually increased since 2010, when it reached 72.8 percent in the wake of the last New York State recession. The area’s highest homeownership rate in the last three decades was 75 percent in 2002, according to a Center for Economic Growth (CEG) analysis of U.S. Census Bureau data.

Coinciding with this homeownership uptick was the first increase in the metro area’s unemployment rate since 2012. In 2017, the rate rose by 0.2 percentage points to 4.3 percent, according to a CEG analysis of New York State Department of Labor data.

Relationship between Homeownership and Unemployment

Although homeownership remains part of the American dream and is supported by a variety of federal, state and local public policies, economists since the mid-1990s have been debating whether it adversely impacts the labor market. Triggering the debate was the 1996 introduction of the so-called “Oswald hypothesis” that claims homeownership impairs owners’ ability to move to places with better job options (“labor mobility”) and can result in higher unemployment rates. Challenging the Oswald hypothesis are several studies showing homeownership actually compels unemployed owners to more aggressively search for and gain employment, even if that means taking a pay cut. However, many of the arguments against the Oswald hypothesis are based on European models that feature public policies that differ from those of their U.S. counterparts.

• Studies Supporting Oswald

o In a white paper released last year, Daniel R. Ringo of the Board of Governors of the Federal Reserve System, concluded, homeownership lengthens unemployment spells by about 50 percent. He said, “home ownership is a significant hindrance to mobility, and homeowners suffer longer unemployment spells and more frequent job loss because of it.”

o In 2013, researchers at Dartmouth College and the University of Warwick in England likewise concluded, “A doubling of the rate of home-ownership in a U.S. state is followed in the long-run by more than a doubling of the later unemployment rate.” Factors driving this trend include, “(i) lower levels of labor mobility, (ii) greater commuting times, and (iii) fewer new businesses.”

• Studies Contradicting Oswald

o In 2015, researchers from the Netherlands found Dutch data on individual unemployment spells contradicted the Oswald hypothesis in that “homeownership tends to accelerate a successful job search.” Furthermore, “homeowners are more likely to leave unemployment than renters, which does not support Oswald’s thesis.”

o In 2008, researchers at Penn State University and the Massachusetts Institute of Technology contradicted Oswald in finding that while “homeowners are less likely to be unemployed, they also have lower wages, all else equal, compared to renters.” However, “while individual homeowners may have inferior labor market outcomes as compared to renters, from the viewpoint of society, higher homeownership rates may result in greater job creation and overall production, among other benefits.”

• Studies with Mixed Support

o In 2006, researchers in Denmark found “owners are less likely to find employment in another region and more likely to find employment locally than are renters, but the net effect of homeownership on unemployment duration is negative, thus contrasting the Oswald hypothesis.” But they added, “It is possible that in countries where geographical mobility is a more important element of the functioning of the labour market (such as in the U.S.), homeownership might have an overall detrimental effect on unemployment. However, this is not likely to be the case in many European countries.”

Local Housing Market Trends

The one-year uptick in the Albany-Schenectady-Troy MSA’s homeownership rate is not a cause for alarm, especially when considering that the 2016 rate of 61.3 percent was the lowest it had been since 1988. The 2017 rate also stood below the 30-year average of 68.4 percent.

Furthermore, a shrinking housing inventory and a decline in new single-family home construction permits could reduce upward pressure on the local homeownership rate. In 2017, Capital Region municipalities approved building permits for 2,763 residential units. That was down 19.1 percent from the previous year but above the 10-year average of 2,637. These approvals included 1,619 single-family units, down 6.1 percent from the previous year, according to a CEG analysis of Census Bureau data. Also in 2017, the greater Capital Region’s single-family residential real estate market averaged 6,654 properties for sale in 2017, down 16.3 percent from the previous year, according to the Greater Capital Association of Realtors.

While it used to be quite common in the 2000s for Capital Region municipalities to approve more single-family than multi-family unit building permits, that has not happened since 2010. The recently released 2018 Sunrise Management & Consulting Multifamily Rental Market Report concluded that rental rates in the four-county Capital Region have slowed considerably after a series of peaks over the past three years. Data from Sunrise’s survey, which covers 175 properties representing 32,661 units, indicates this market is getting saturated.

CEG Activities

Regardless of whether the Oswald hypothesis applies to the Capital Region’s housing and labor markets, CEG is engaging in activities that both boost homeownership and reduce unemployment. These activities include the following:

• Representing the Capital Region at industry trade conferences worldwide to attract high-paying technology companies that put homeownership within reach for employees;

• Attending career fairs throughout the Northeast to recruit highly skilled talent for CEG investors (Talent Connect);

• Helping out-of-region new hires determine where in the Capital Region they should live and connecting them with local Realtors and/or property management firms (Talent Connect);

• Helping local manufacturers operate more efficiently, tap new markets and accelerate innovation and commercialization, enabling them to expand their workforce (Business Growth Solutions);

• Providing technical support for mixed-use projects under the Metro Strategy of Capital 20.20, such as the redevelopment of the First-Prize site in Albany and Colonie;

• Sponsoring a Capital Region Manufacturing Intermediary Apprenticeship Program (MIAP) to help manufacturing employees build their skills and obtain higher-paying jobs;

• Assisting Hudson Valley Community College in developing a boot camp program to prepare unemployed and underemployed workers for careers in manufacturing, as well as providing funding for this initiative through KeyBank; and

• Assisting Schenectady County Community College in developing a certified production technician program, as well as providing funding for this initiative through KeyBank.

Don’t miss these insights into the trends that are shaping the Capital Region’s economy. Sign up for CEG’s e-news and follow us on: