Pharma Industry Funds 100s of Drug Clinical Trials in Capital Region

The pharmaceutical industry has started conducting hundreds of clinical trials at Capital Region medical facilities in recent years, and more drug testing is expected as the local Life Sciences Cluster vastly expands with several multimillion-dollar projects.

Emerging Clinical Trial Support Assets

The pharmaceutical industry funded 342 clinical trials for drug interventions that started between 2014 and 2018 and that have locations in the region, according to a Center for Economic Growth (CEG) analysis of data from ClinicalTrials.gov.

The region’s Life Sciences Cluster already has a robust drug development infrastructure, which spans from R&D to manufacturing. Clinical trials represent an important step between the two. Several projects that will enhance this infrastructure are underway. They include:

Albany College of Pharmacy and Health Sciences: While the first phase of the college’s $37 million Center for Biopharmaceutical Education and Training will focus solely on expanding academic programs, future implantation phases may support clinical studies involving facility.

Regeneron Pharmaceuticals: Its $800 million second campus in East Greenbush will support the company’s ability to make investigational medicines for study in clinical trials all around the country.

New York State Department of Health Wadsworth Center: A recent Deloitte study found the new $750 million Wadsworth Center in Albany could become a major industry partner in population genomics by utilizing state and healthcare data, biobank assets and private sector information to create a large genomic data repository. That repository could be used “to develop, validate, and demonstrate value of multigene panels for identifying known and suspected mutations associated with to enable effective treatment, trial matching, and clinical decision support.”

Funding Sources

The 342 industry-funded clinical trials accounted for 79.5 percent of the total 430 local drug clinical trials started regionwide between 2014 and 2018. The National Institutes of Health (NIH) funded 16.7 percent of those clinical trials and other public and private sources funded 5.8 percent of them.

Conditions & Phases

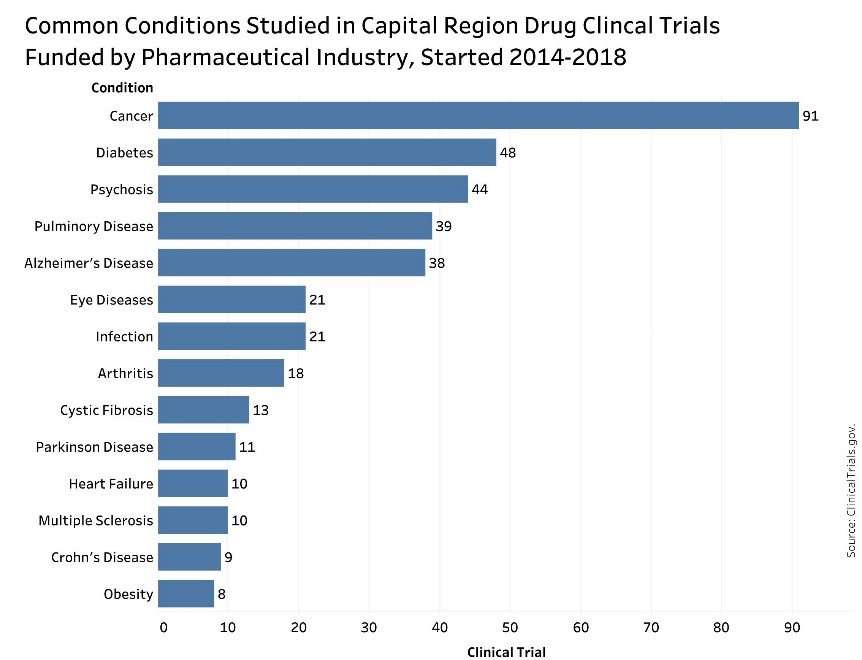

Cancer was the most common condition targeted in the region’s industry-funded drug clinical trials. Over the past five years, 91 cancer-related, industry-funded drug clinical trials have started in the region. Other common conditions included diabetes (48) psychoses (44), pulmonary disease (39) and Alzheimer’s disease (38).

Among the four phases of clinical trials, the most common among those that started in the region over the past five years were Phase 3 (63 percent). These trials, according to ClinicalTrials.gov, build off the preliminary data on effectiveness collected in Phase 2 (29 percent) and look to “gather more information about safety and effectiveness by studying different populations and different dosages and by using the drug in combination with other drugs.” Only 3 percent were Phase 1 trials, which are conducted on healthy volunteers to evaluate drug safety; and 5 percent were Phase 4 trials, which occur after the U.S. Food and Drug Administration has granted drug marketing approval and “gather additional information about a drug’s safety, efficacy, or optimal use.”

Locations and Sponsors

Almost a quarter of the region’s industry-funded drug clinical trials were conducted at New York Oncology and Hematology (42), Albany Medical College (37) and Albany Medical Center (22). Several pharmaceutical companies, such as Novo Nordisk (19), Novartis (6) and GlaxoSmithKline (3) have investigational sites in the region. Other locations with multiple industry-funded drug clinical trials included the Center for Rheumatology (10); Glens Falls Hospital (9), including the C. R. Wood Cancer Center; and Neurological Associates of Albany (9).

Some of the leading sponsors and collaborators of the region’s industry-funded drug clinical tests were Hoffman-LaRoche (22), Novo Nordisk (20), Eli Lily and Company (18), and Bristol-Myers-Squibb (16).

CEG and the Life Sciences Cluster

CEG is supporting the growth of the region’s life sciences cluster by engaging in the following activities:

Marketing the Capital Region’s life sciences R&D assets at talent pipeline at biotech conferences.

Supporting the attraction to the region of new biotech companies, such as PiSA BioPharm and ILÚM Health Solutions.

Conducting a Life Sciences Cluster analysis that developed an action plan for: 1. improving the commercialization of local life sciences innovations, 2. strengthening the region’s life sciences ecosystem; 3. and recruiting contract research organizations (CROs) to the region.

Assisting life sciences startups with accessing labs, office space, and other facilities; developing venture pitches; identifying potential investors and mentors.

Helping biotech firms, such as Vital Vio and Somml Health, grow through a suite of Business Growth Solutions services, such as continuous improvement, technology acceleration, energy and sustainability, supply chain development and workforce initiatives.

Don’t miss these insights into the trends that are shaping the Capital Region’s economy. Sign up for CEG’s e-news and follow us on: