Capital Region Opportunity Zone Highlights

Even before New York State designated 20 Capital Census Tracts as Opportunity Zones in 2018, half of them had growing populations and four in five had increasing ranks of employed residents. The federal Opportunity Zones community development program is now promising to build on that momentum and is already attracting millions of dollars in private investment in low-income urban and rural communities.

Population Growth

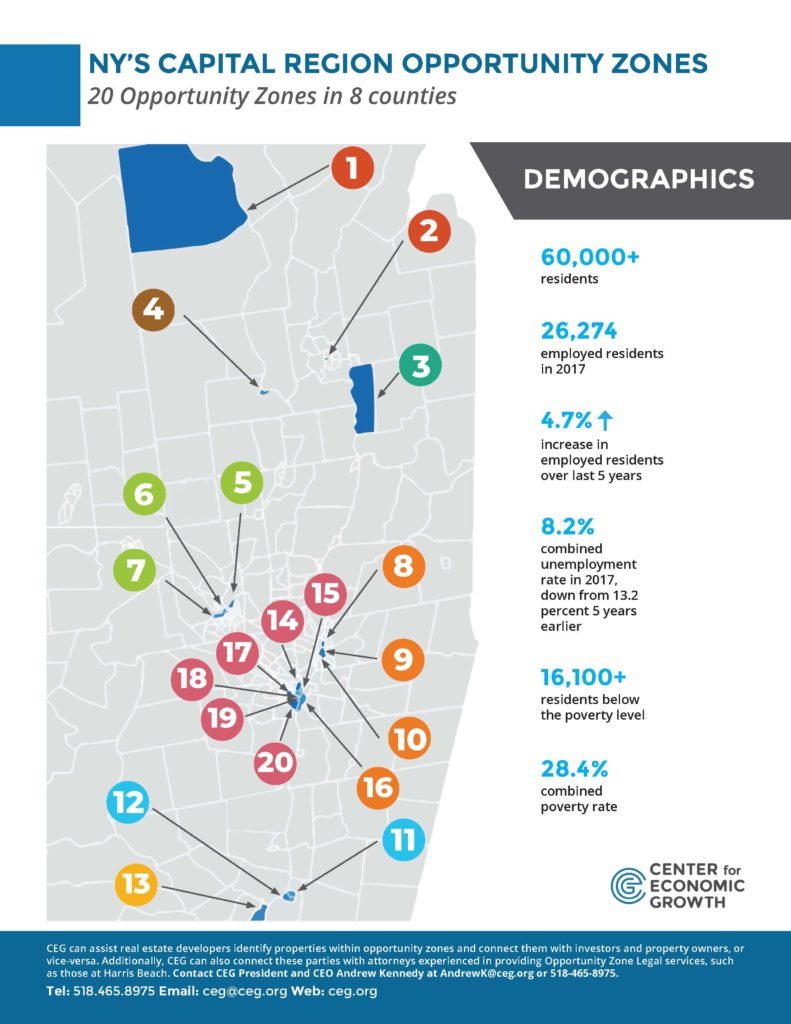

More than 60,000 people lived in the eight-county region’s Opportunities Zones as of 2017. Their populations ranged from 6,477 (Census Tract 880 in Fort Edward) to 923 (Census Tract 210.01 in Schenectady). Over the past five years, their cumulative population had declined by 0.1 percent, though during that period some sizeable tracts grew as much as 29.2 percent (Census Tract 25 in Albany), according to a Center for Economic Growth (CEG) analysis of U.S. Census Bureau five-year estimates.

Employment Growth

Employment growth was even stronger in the 20 Opportunity Zones. Between 2013 and 2017, the Opportunity Zones’ ranks of employed residents increased by 4.7 percent to 26,274. During that five-year period, their cumulative unemployment rate declined to 8.2 percent from 13.2 percent. Almost one in three Opportunity Zone workers were employed in the educational services and health care and social assistance sectors.

Poverty

Despite these positive trends, the region’s Opportunity Zones continue to face challenges. To qualify as a zone, a Census Tract must have an individual poverty rate of at least 20 percent or have a median family income no greater than 80 percent of the statewide median family income (non-metro area tracts), or no greater than 80 percent of the statewide or metro area median family income (metro area tracts). More than 16,100 people in the zones live below the poverty level. Their combined poverty rate was 28.4 percent in 2017, with rates being as low as 10.3 percent (Census Tract 740 in Johnsburg/North Creek) and as high as 51.5 percent (Census Tract 210.01 in Schenectady).

Projects

Several major Capital Region projects are already underway in Opportunity Zones. Many of them were designated by the Capital Region Economic Development Council as priority or regionally significant projects and received $4.7 million in the 2018 REDC Awards. Examples include:

- Applicant: 669 River Street, LLC

- Project: The Paint Factory Mixed-use Building

- Location: North Central Troy

- Award: $700,000

- Applicant: Front Street Mountain Development

- Project: Ski Bowl Mountain Inn

- Location: Johnsburg

- Award: $800,000

- Applicant: Capital Roots

- Project: The Urban Grow Center

- Location: Troy

- Award: $1,136,238

- Applicant: Palace Performing Arts Center, Inc.

- Project: Palace Theatre Renovation and Revitalization Project Description

- Location: Albany

- Award: $360,000

- Applicant: City Station North, LLC

- Project: City Station North 2018

- Location: Troy

- Award: $1,700,000

- Applicant: Redburn Development

- Project: Kennedy Garage Netzero

- Location: Albany

- Award: $1,010,202 (plus $5 million ESD grant for related project)

CEG Activities

CEG can help real estate developers identify properties within opportunity zones and connect them with investors and property owners. Additionally, CEG can also connect these parties with attorneys experienced in providing Opportunity Zone Legal services, such as those at Harris Beach. Harris Beach PLLC is a full-service legal and professional services firm with offices in Albany and Saratoga and a CEG investor. The firm works provides a range of support for individuals, organizations and municipalities interested in Opportunity Zones:

For real estate developers: Firm attorneys can help developers understand and establish the optimal structure for taking advantage of Opportunity Zone tax benefits and how to leverage investments with programs such as New Markets Tax Credits, Pilot Increment Financing and Industrial Development Agency benefits.

For investors: Firm teams stand ready to help establish self-directed Qualified Opportunity Funds or review potential investments in one of those funds. Investors receive tax benefits on gains invested in Opportunity Zones through special funds.

For communities: Firm attorneys guide municipalities in setting up an LLC and self-directing funds for specific projects.

Harris Beach, through its Capital Region offices, also provides a full-range of legal and professional services for any additional needs that may arise from the Opportunity Zone program or other matters.

Don’t miss these insights into the trends that are shaping the Capital Region’s economy. Sign up for CEG’s e-news and follow us on: